Merit Assumptions - Compease

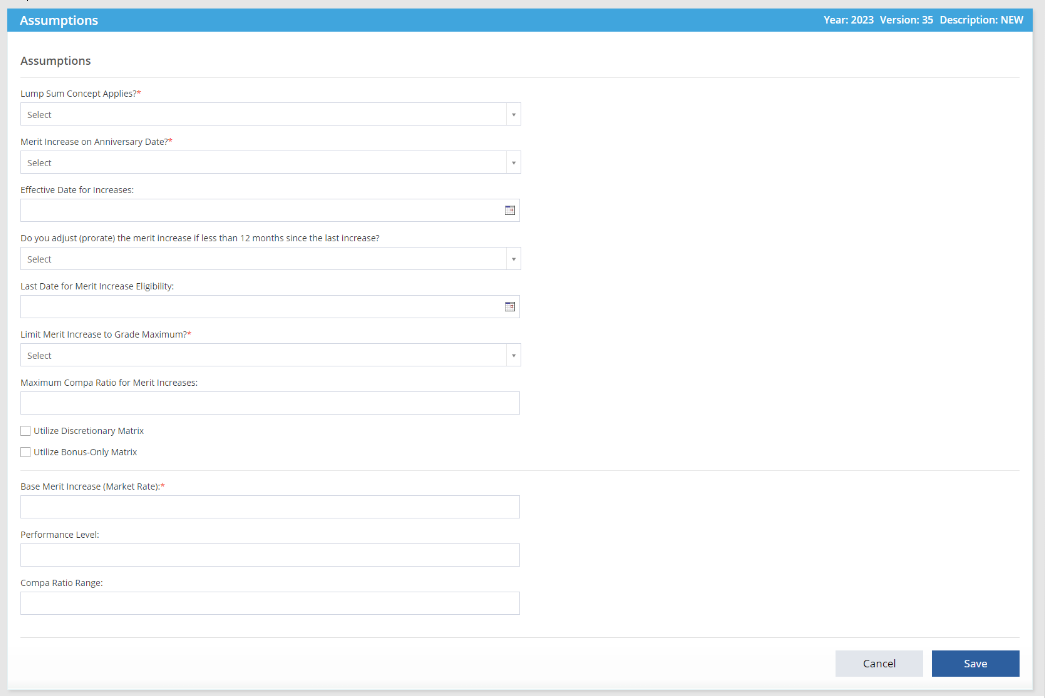

Merit Increase Planning-->Merit Model-->Assumptions:

Fill out the Assumption fields to format your merit matrix.

-

Lump Sum Concept Applies? – Yes/No

If Yes is selected, once an employee reaches the maximum compa ratio set, the merit increase will be awarded as a lump sum bonus. If No is selected, an employee would no longer receive an increase after reaching the maximum threshold.

-

Merit Increase of Anniversary Date? – Yes/No

If Yes is selected, employees will receive increases 12 months after the last increase date listed in their employee record. If No is selected, all employees receive increases at a specific date.

-

Effective Date for Increases

If No was selected in the above question, the effective date for increases must be completed on the next line. If Yes was selected above, no date is required in this field.

-

Adjust (prorate) Merit Increase if less than 12 months since last increase – Yes/No

For merit increases paid at a focal point, this allows you to prorate increases if someone has earned an increase more recently than 12 months ago. If Yes is selected, it will prorate any employee who received an increase more recently than 12 months from the increase date. If No is selected, all employees will receive a full increase, regardless of the last time one was received.

-

Last Date for Merit Increase Eligibility -

Regardless of whether prorating is On or Off, but eligibility is limited to a date, the employees will receive a full merit increase if the employees last increase date is prior to the "cut off" date. An employee whose last increase date is after the eligibility date will have a merit increase of 0%, but the employees and annual compensation will be included in the plan if they are copied into the model.

-

Limit Merit Increase to Grade Maximum? – Yes/No

If Yes is selected, increases will stop at the top of the salary range (120% for exempt and non-exempt employees and 125% for executive employees). If No is selected, you must select your own maximum compa ratio threshold. If the lump sum is being used, this threshold indicates when it will take effect.

-

Maximum Compa-Ratio for Merit Increases

If No was selected in the above question, fill in an appropriate percentage to use instead of the maximum of the salary ranges.

-

Base Merit Increase (Market Rate)

This is the amount your salary ranges move from one year to the next. HR Performance Solutions can provide you with this information. In the last few years, it has been near 2%.

-

Performance Level

This is the percentage a top performer should receive over an average performer. Depending on budget, we typically recommend somewhere between 2% and 3%. This number needs to be large enough that your top performers can see the difference their performance had on the size of the increase.

-

Compa Ratio Range

This references the compa ratios of your employees. The percentage is the amount an individual in the lowest position in range will receive. We typically recommend nothing smaller than 3% as this needs to be larger than the speed at which the salary ranges are moving.

-

Click Save. This will automatically bring up the View/Edit Matrix screen.

See below for a video of these instructions.

![HRPS Logo1.png]](https://knowledgebase.hrperformancesolutions.net/hs-fs/hubfs/HRPS%20Logo1.png?height=50&name=HRPS%20Logo1.png)