Entering Employee Salary Data - Performance Pro

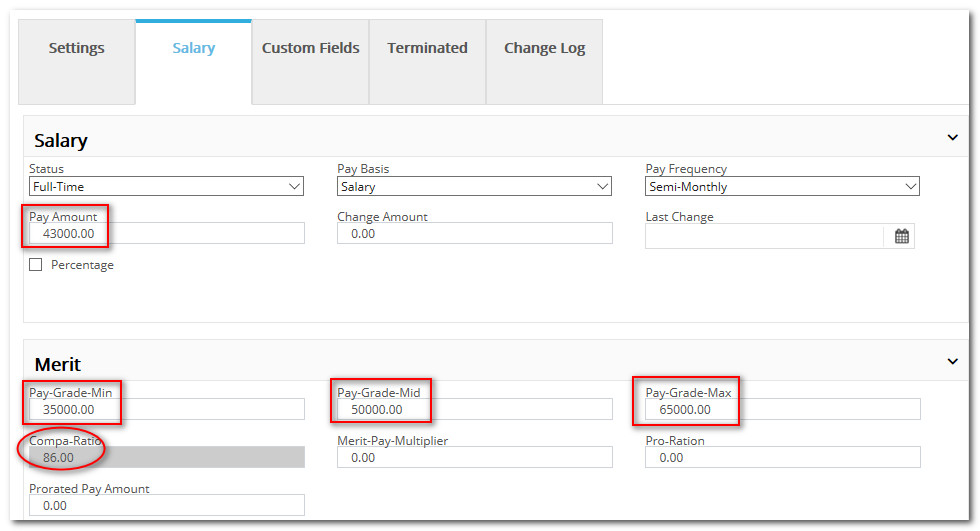

The Employee's Pay Amount, Pay Grade Min, Pay Grade Mid, and Pay Grade Max fields must be populated for the Adjust Merit Pay table to calculate proposed increases.

Click Manage Employees.

Click Employee Data.

Select the Salary tab.

Enter Salary Data.

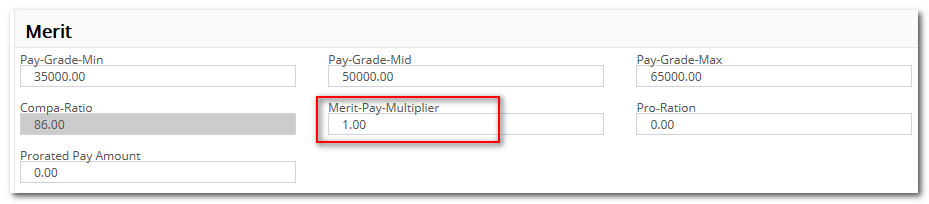

Merit Pay Multiplier

The Merit Pay Multiplier can be used for employees who are very low in their salary range and whose movement through the range you would like to accelerate, getting them closer to the mid-point of their salary range. For example, if you enter a 2, their proposed increase % will be multiplied by 2. Use 1.0 unless you are wanting to accelerate their movement.

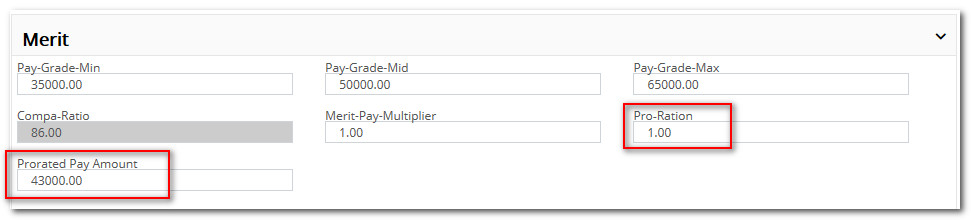

Pro-Ration

The Pro-Ration field is used in the following circumstances: The employee has been employed for less than one year, or the increase needs to be applied to more than their current pay amount. The field is included in the merit increase calculations and will affect the Current Pay Amount figure in the Adjust Merit Pay table and any export. When the pro-ration value is one (1), the pay amount will be unaffected (current pay x 1 = current pay), and it will not generate the pro-ration superscript on the Adjust Merit Pay table. When the pro-ration value is zero (0), the current pay amount will be multiplied by 0, resulting in no projected increase percentage/increase amount for the employee and a pay amount of zero (0).

Prorated Pay Amount

Data will fill this field based on a calculation of the "Pay Amount" x "Pro-Ration" field. The field exists so managers involved in the salary budgeting process have the actual pro-rated salary amount for that year. A full year salary will display in the Adjust Merit Pay table for full-year budgeting purposes.

Did this answer your question?![HRPS Logo1.png]](https://knowledgebase.hrperformancesolutions.net/hs-fs/hubfs/HRPS%20Logo1.png?height=50&name=HRPS%20Logo1.png)